I wish I had known this when I started in self storage.

- Marc Goodin

- Oct 28, 2023

- 4 min read

By Marc Goodin

Competition data provides a great head start when looking for Self storage land. And interpretation of the data is not always straightforward. Back in 2008 self storage data was limited. I just picked 2 sites on main roads and built them. I was lucky I at least understood the need for drive-by traffic. Now I understand the importance even more. Both sites have the same demographics and demand but one has 10,000 cars a day and the other one has 22,000 cars a day. Hands down the the 22,000 car facility is doing better because of the traffic. Now imagine there are 8 more main factors and meeting them on the low side vs the high side can make a Huge difference in profits.

When I built my first 2 self storages in the great depression of 2008/2009 there was no outline of what made a great self storage site or apps we have now to help you find the information on your competition or demographics in your area. Just 6 years ago it took a couple of 8 hours days to gather the info now that takes an hour or two. This means 2 things. We can quickly analyze more sites to find better sites. And we can sometimes overanalyze sites and pass on great sites.

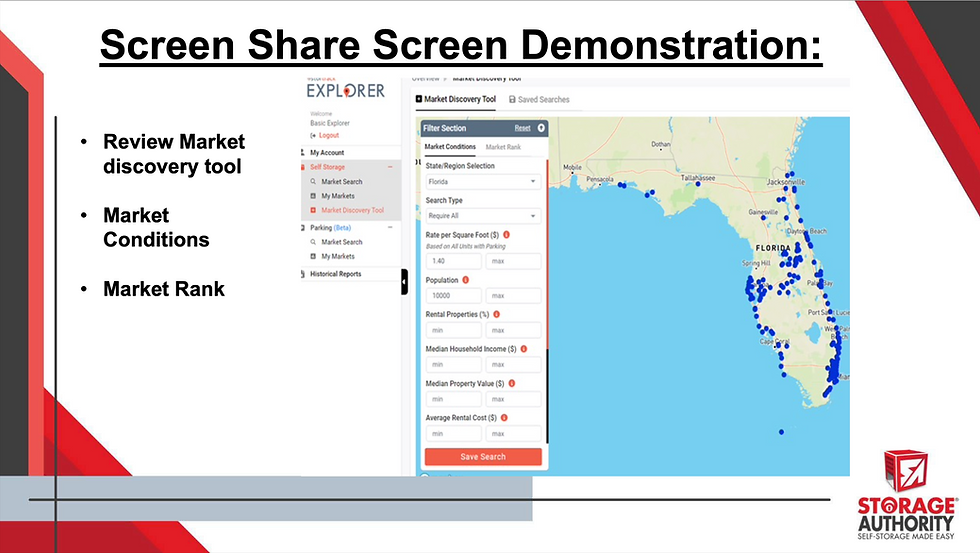

Today we had Jim from Stortrack (www.stortrack.com) as our guest speaker on our quarterly development meeting for Franchise owners. We have been using the app for a while but I was amazed at how little of the information I was using and how much additional information they have added recently. I was especially excited to learn how the site can help you locate areas to search for site self storage. Once you are investigating a specific property they provide a ton of valuable information.

Stortrack allows you to choose your site criteria based upon several parameters such as location (city or state) min/max rental rates, apartments, demand, and more.

The second half of the seminar was about determining how to estimate what you will be able to charge at your facility. If you have done any preliminary Profit and Loss concept reviews you most likely have come up with an average rental rate you need to charge to make an acceptable profit. It can vary depending on facility, size, marketing, land cost, the amount borrowed, and a host of other factors. But to start, I often use an average rental rate of $1.6 SF min. So, if you had 62,000 sf of net rentable sf your income per year would be $1.60 x 12 months x 62,000 sf = $1,190,400 income per year.

How you determine what you can charge is part math, part art, and part science. In other words, you need a lot of experience.

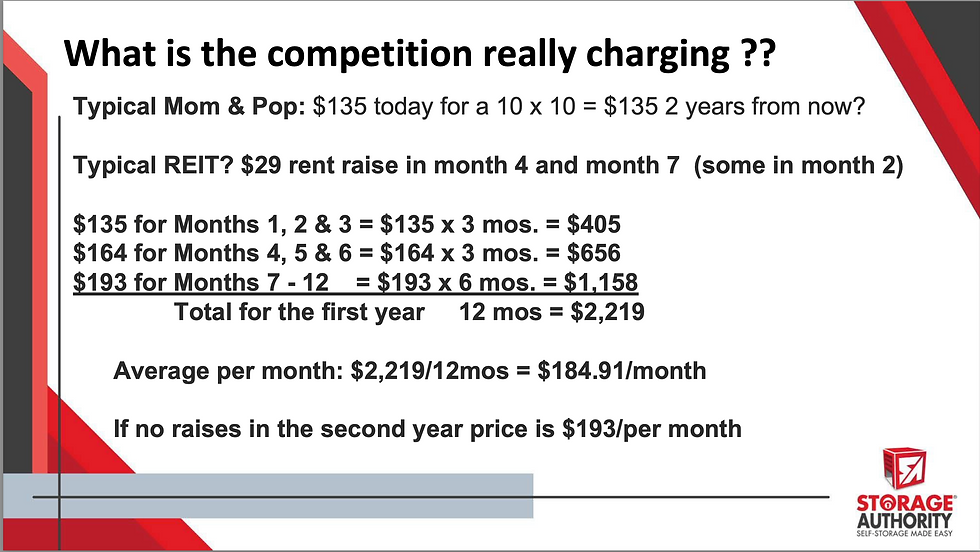

You might think if the Reits in your 3-mile radius have an average of $130/sf in your 3-mile radius you should pass on the site. This would be a wrong assumption. First, you have to realize that self storage has seasonal high rates and low peak rental times. The Reits traditionally lower their rates, like clockwork, for the slow months of November and December and rates can drop significantly.

Reits and many medium operators (5 – 19 facilities) Raise their rates twice in 9 months or less so their average rates is substantially more than the teaser rate they publish online. When you secret shop all your completion ask how long before they raise their rates. You will be surprised either will tell you 2 months or they will not tell you.

Even if there is only one rental increase or smaller rental increase what you see advertised by the REITs is not the average for the year.

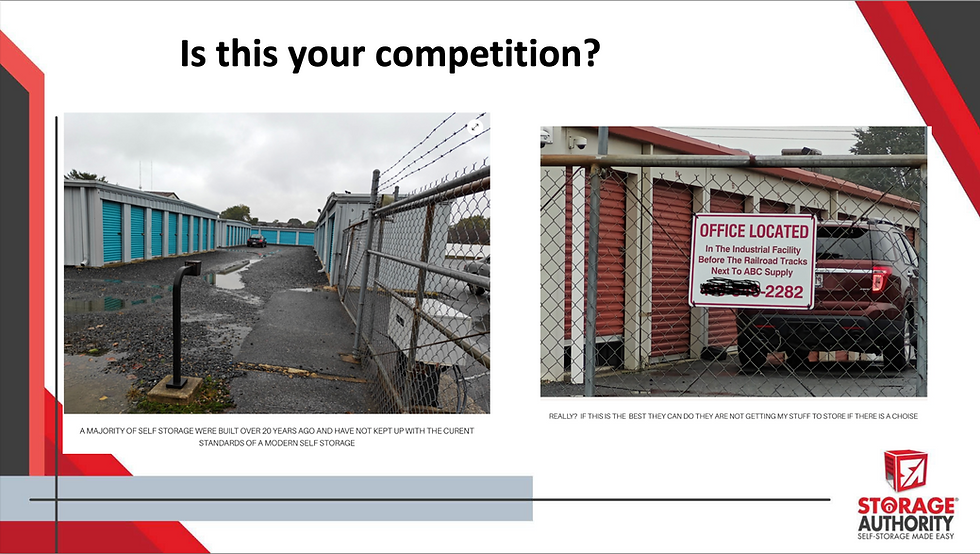

And who says you can not charge more than the Reits and mom and pops with superior marketing and sales? And for sure you can often charge more than the non-Reit facilities if they look anything like this.

Is there a perfect way to know the average rental rate per sf for your competition? No there is not. Even if you get all the rates and average them together this is not the average for the facility. Two full facilities can have the same rental rates for each size but the one with the more smaller units will have a higher facility rental rate per sf. Stortrack will provide averages but they are based upon many assumptions and include all facilities, even like the ones above. Step one is to visit the competition and see if any facilities can be thrown out.

Without going into detail and providing the details I have often observed in feasibility studies and actual facilities with the known number of units and rates per unit size the average rental rate for an all-climate control facility can be around the price of a 10 x 10 climate control unit. The average rental rate for a mixed facility of 2/3 climate control and 1/3 non-climate control is the price of a non-climate control 10 x 10 unit. Again this can vary so you need a good feasibility study in the end but at least this should help you understand that an area with all facilities charging $100 a month for a 10 x 10 can quickly be skipped.

Do you want to have a 15-minute call to learn how Storage Authority helps improve the systems, sales, marketing, and profits at your existing facility? If you are building from the ground up let's also review how we help you find land and get your facility designed, approved, and built.

Please send me an email or call me – no appointment is needed:

marc@StorageAuthorityFranchise.com or 860-830-6764

Get more information on Storage Authority Franchise at www.storageauthorityfranchise.com/opportunity3

Marc Goodin is the President of Storage Authority Franchising. www.StorageAuthorityFranchise.com He owns 3 self-storages he designed, built, and manages. He has been helping others in the self-storage industry for over 30 years. He can be reached at marc@StorageAuthority.com or directly at 860-830-6764 to answer your franchising, development, marketing, sales, and operations questions. His best-selling self-storage books are available on Amazon.

#storageauthority #selfstoragefranchise #selfstorage #selfstorageprofits #entreprenuer #startups #realestatedevelopment #franchise #storage #residualincome #franchiseopportunities

Comments